PIT 11, PIT 37, IFT 1R - What does it mean?

What are the PIT 11, PIT 37, IFT 1R?

The PIT-11 is a form that contains information on the employee's annual income and taxes paid. In Poland, the employer is subject to personal income. He is obliged to send this information to all employees until the end of February. In case of working in different places during the year,an employeereceivesa PIT 11 from each employer and after that he has to file the PIT 37 form.

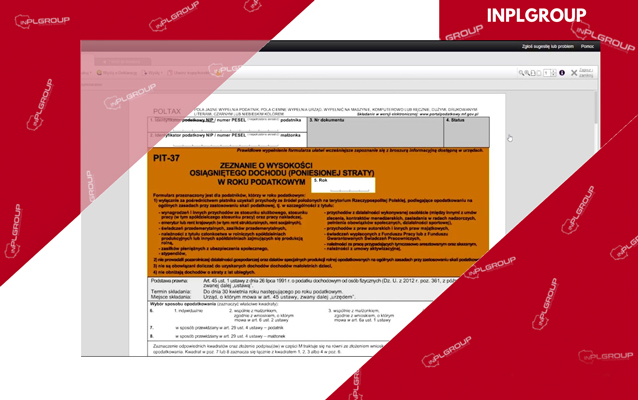

The PIT 37 is the tax return for the last year of work in Poland. If the employee does not carry out business activities, he has to fill out this declaration and send it to the tax office. This must be done before the end of April next year, i.e. the PIT 37 for 2018 should be filed before April 30, 2019. The corresponding tax is paid at the same time.

The IFT 1 and IFT 1R forms

These forms are issued only to those persons who are not the tax residents of the country. In this case, the employer sends the employee income data to the tax office and a copy of it - to the employee himself. If the IFT 1 and IFT 1R forms are filled out, there is no need to fill PIT 37.

Filing a tax return

There are several ways to file a declaration in Poland:

at the tax office at the place of residence

using special programs for electronic declarations, that can be downloaded for free on the tax office website

at the post office of Poland

through the Consulate of Poland

via the Internet.

What if I fail to submit the PIT 37 on time?

Failure to submit a declaration is fraught with the fine and possible imprisonment. In this case, you can use the right of repentance. This means that a person admits a violation of the law. Then he will have to pay only overdue tax. This should be done before the violation is discovered.

Contacts

-

Kraków 31-509, ul. Aleksandra Lubomirskiego 39/1 +48 882-488-166 +48 571-807-904 [email protected]

-

Lublin 20-340, ul. Garbarska 18/10 +48 512-895-895 [email protected]

-

Katowice 40-082, ul. Sobieskiego 2 +48 514-375-043 +48 793-849-692 [email protected]

-

Warszawa 00-001, ul. Janka Muzykanta 60 +48 784-971-203 +48 793-849-692 +48 534-315-931 [email protected]

-

Wrocław 54-203 ul. Legnicka 55F/356 +48 503-634-667 +48 534-315-931 [email protected]