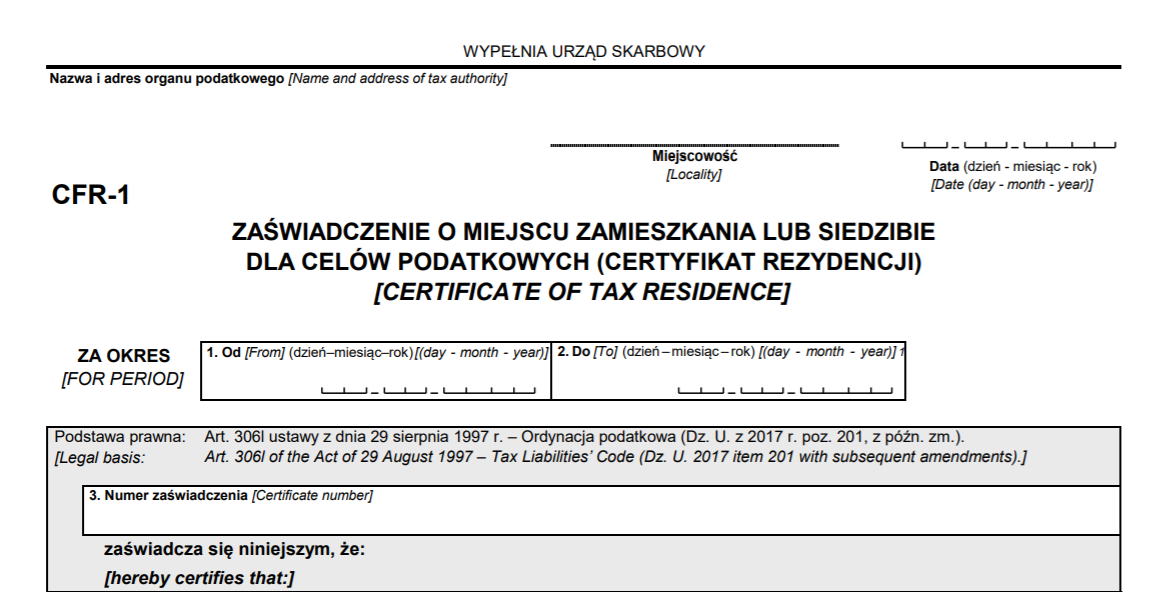

Tax residency certificate (CFR-1)

A certificate of Tax Residency (CFR-1)

Certyfikat rezydencji podatkowej

What is a tax resident certificate, and where can I get it?

A tax resident certificate or a residency certificate officially confirms the existence of a fiscal link between a citizen/individual entrepreneur/legal entity and the state.

This certificate is necessary to avoid double taxation (in your country and in the country of actual residence, in our case in Poland).

To obtain a tax resident certificate in Poland, you need to contact Urząd Skarbowy at the place of registration.

Waiting time for receiving the tax resident certificate in Poland is 7 business days after applying for a CFR-1 form and paying for the certificate.

Two main conditions for determining tax residency in Poland

The first condition. In order to obtain tax residency in Poland, one of two conditions should be met, i.e., a tax resident is considered to be a person:

whose personal and economic interests are concentrated in Poland (center of vital interests)

whohas stayed in Poland for at least 183 days for a given tax period.

These two criteria may not be related. According to Polish law, a taxpayer is recognized as a Polish tax resident if he or she meets only one of these conditions. After obtaining this status, a person is obliged to pay taxes in Poland on all his world income.

Duration of stay in Poland

The second condition that determines the status of a tax resident is related to the length of his stay in Poland. A person residing in Poland is considered to be a person who stays in this country for more than 183 days during the tax period (1 year). This refers to the total number of days of stay (the days of physical presence) in a given calendar year (not during any subsequent 12 months). Under the law there is no need to stay in the country continuously - the necessary period can be gained for several visits to Poland during a given tax year.

Once our tax residency has been determined, we can move on to the next step. It is necessary to find out which sources of income in Poland are taxable (e.g., income from wage labor, rental income, interest on foreign bank accounts, pensions, dividends, profits from foreign enterprises, etc.).

When filling out the tax form, you have to specify the type of income (e.g., PIT-37, PIT-36, PIT-38, PIT-28, PIT-CFC, etc.) and tax conditions (progressive taxation or 19% fixed tax), whether it is taxable only on an annual basis or there are any monthly obligations (as in the case of income from wage labor), whether you pay taxes abroad and what tax benefits are provided to you in Poland.

Contacts

-

Kraków 31-509, ul. Aleksandra Lubomirskiego 39/1 +48 882-488-166 +48 571-807-904 [email protected]

-

Lublin 20-340, ul. Garbarska 18/10 +48 512-895-895 [email protected]

-

Katowice 40-082, ul. Sobieskiego 2 +48 514-375-043 +48 793-849-692 [email protected]

-

Warszawa 00-001, ul. Janka Muzykanta 60 +48 784-971-203 +48 793-849-692 +48 534-315-931 [email protected]

-

Wrocław 54-203 ul. Legnicka 55F/356 +48 503-634-667 +48 534-315-931 [email protected]