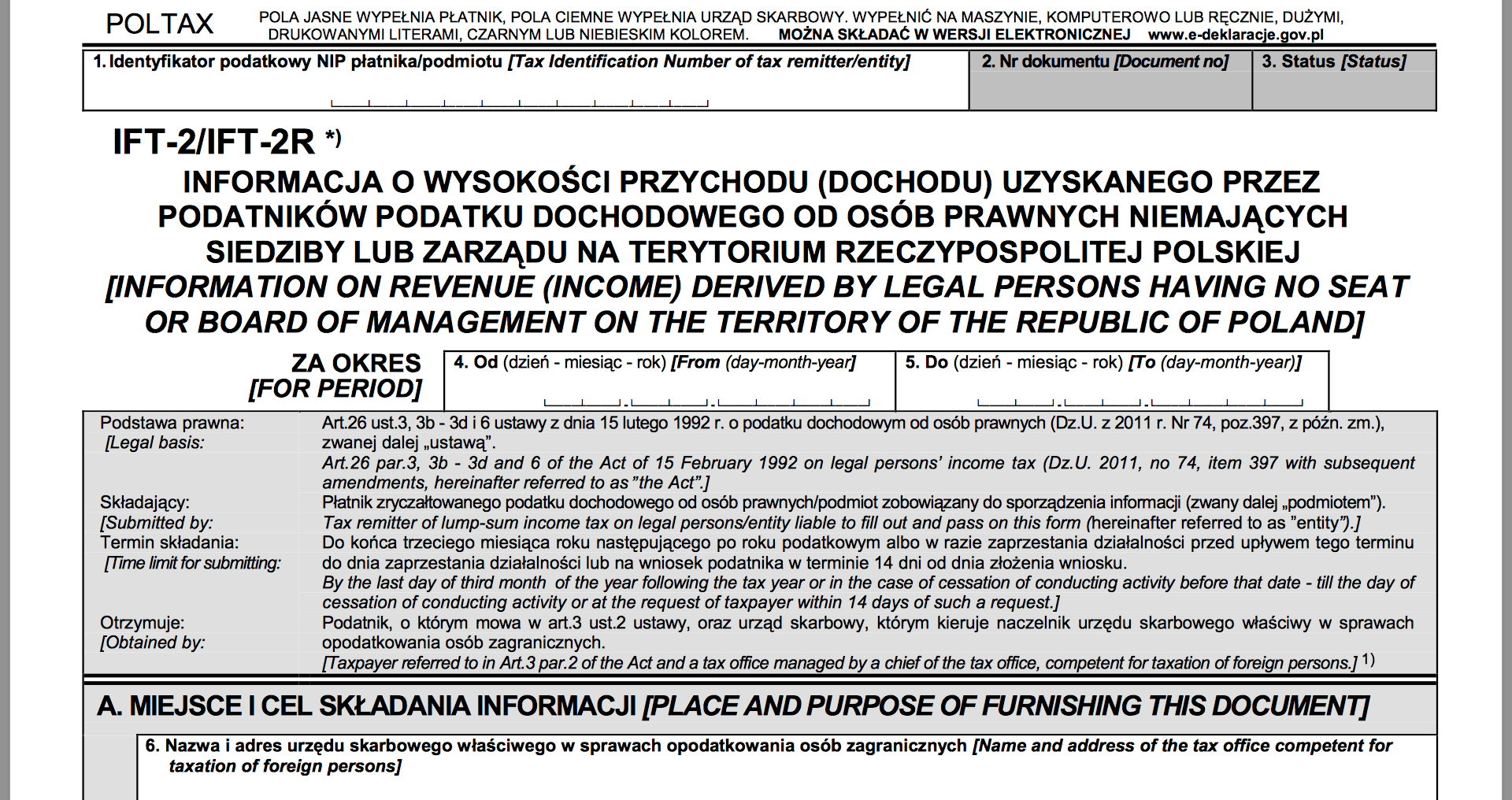

IFT-1 and IFT-1R - What is this?

The IFT-1 and IFT-1R forms

The IFT-1 and IFT-1R forms are issued if the foreigner is not a tax resident of Poland.

The employer is obliged to provide the tax office (which keeps a record of the foreigners) with information on the income of such an employee by submitting the IFT-1/IFT-1R form (electronically - by the end of February next year, in the paper - by the end of January). A copy is also provided to the employee.

A non-resident is a person who worked in Poland for less than 183 days last year. In this case, the employer issues the IFT-1/IFT-1R form and the employee is not required to file the PIT-37 to the tax office.

The tax authorities of Ukraine tend to consider all owners of the Ukrainian passport as the tax residents of Ukraine. Therefore, they demand to pay taxes if they reveal the facts of obtaining income abroad. To avoid this, you need to prove the status of a non-resident. If a person can prove that he is a non-resident, then he is exempted from filing a declaration and paying the taxes on the foreign income in Ukraine.

If a person is recognized as a tax resident of Ukraine, he is obliged to pay in Ukraine a personal income tax (PIT) at the rate of 18% of all income received and a military fee of 1.5% of the income, including the income received abroad. The single social contribution (SSC- 22%) is not levied on foreign income.

In most cases, Ukrainians working abroad hope that the tax service of Ukraine will not detect these incomes. But between Ukraine and many countries there is a selective exchange of tax information on individual requests. Since Ukraine has joined the BEPS plan, the CRS standard (automatic exchange of tax information) can be introducedbetween countries. Then the tax service will be able to get information about all foreign accounts owned by Ukrainians in foreign banks. It may not happen until 2019-2020.

How to replace an IFT-1R with a PIT-11

If you do not agree that you have been issued with an IFT-1R form instead of an RT-11 (on the basis of which you can prepare and file the PIT-37 tax returnand get a chance to refund the part of the taxes), then you have the right to write a request to your employer to renew your tax declarations for PIT-11.

Contacts

-

Kraków 31-509, ul. Aleksandra Lubomirskiego 39/1 +48 882-488-166 +48 571-807-904 [email protected]

-

Lublin 20-340, ul. Garbarska 18/10 +48 512-895-895 [email protected]

-

Katowice 40-082, ul. Sobieskiego 2 +48 514-375-043 +48 793-849-692 [email protected]

-

Warszawa 00-001, ul. Janka Muzykanta 60 +48 784-971-203 +48 793-849-692 +48 534-315-931 [email protected]

-

Wrocław 54-203 ul. Legnicka 55F/356 +48 503-634-667 +48 534-315-931 [email protected]