REGON - What does it mean?

What is a REGON number in Poland?

The REGON registry in Poland

The REGON (Rejestr Gospodarki Narodowej) is the all-Polish registry of national economic entities of the Republic of Poland. The registry was created for statistical purposes and is maintained by the Main Statistics Office of Poland - GUS.

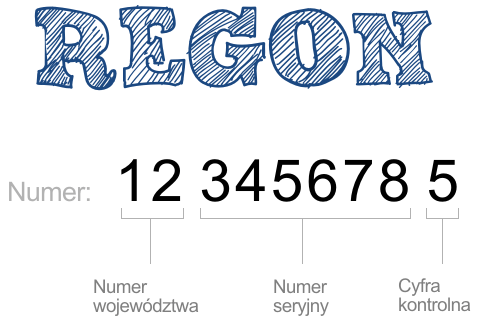

Entities who conduct business in Poland are required to be registered in the REGON registry and have to receive a 9-digit statistical number.

The requirement also applies for:

companies and partnerships (Sp z o.o)

individuals - individual entrepreneurs

How to get a REGON number?

The REGON number is assigned by the Central Statistical Office (GUS). Obtaining REGON is completely free, but the way you get it depends on the form of business.

There are two ways to register Sp. z o.o. in Poland:

We have described them in our article www.inpl.eu/ru/chto-takoe-sp-z-oo.html

If you register a company (for example, Sp z o.o.) through the S24 online registry system, you will automatically receive a REGON number, as well as KRS and NIP number, by applying for registration of the company in the National Court Register (KRS).

The REGON number can also be obtained automatically by individuals who register with CEIDG as individual entrepreneurs.

In this case, the request for providing the REGON registry number is submitted automatically along with the CEIDG-1 form.

In other cases, in order to obtain the REGON number, the RG-1 form is submitted to the relevant office of the district court, which conducts registration.

Confirmation of the company registration in the KRS court register will also need to be attached to the form.

What is a REGON number for?

Currently, the REGON number is not as important as it was about a decade ago. Since 2009, it has ceased to be mandatory in official transactions. There is also no need to put the REGON number on the company's seal. This means that it is not necessary to indicate it in VAT invoices or various types of securities that are addressed to the tax office and social insurance institution.

However, the REGON number is required, for example, in the case of trademark registration in the Patent Office of the Republic of Poland, when the applicant is a legal entity (e.g. a joint-stock company).

With the REGON number you can find the following in the database:

company name

owner’s name

owner’s PESEL

taxpayer ID number

type of enterprise

company address

company law form

estimated number of employees

the date of creation

possible dismissal or termination of activity.

All data is collected for informational purposes only.

Contacts

-

Kraków 31-509, ul. Aleksandra Lubomirskiego 39/1 +48 882-488-166 +48 571-807-904 [email protected]

-

Lublin 20-340, ul. Garbarska 18/10 +48 512-895-895 [email protected]

-

Katowice 40-082, ul. Sobieskiego 2 +48 514-375-043 +48 793-849-692 [email protected]

-

Warszawa 00-001, ul. Janka Muzykanta 60 +48 784-971-203 +48 793-849-692 +48 534-315-931 [email protected]

-

Wrocław 54-203 ul. Legnicka 55F/356 +48 503-634-667 +48 534-315-931 [email protected]